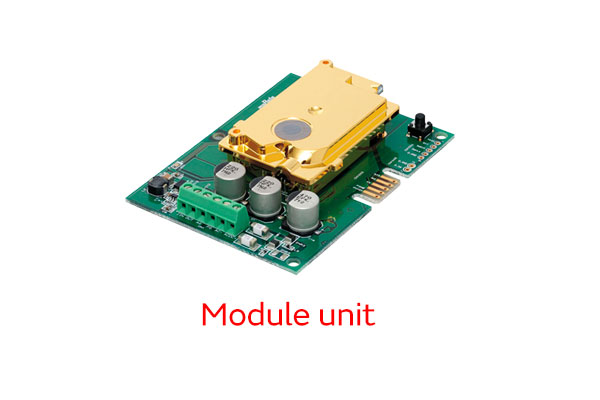

CO2 sensor

Agriculture × advanced technology = smart agriculture: Japanese agriculture is now attempting to open up a new model of agriculture with this equation.

According to the Ministry of Agriculture, Forestry and Fisheries (MAFF), the number of self-employed farmers, decreased from approximately 4 million in 2000 to approximately 2.5 million in 2010. This number further decreased to 1.36 million in 2020. Those aged 65 years and older account for 950,000, or approximately 70%, of that group, with an average age of . Their average age is 67.8 years old. Given the significant decrease in this working population, In the face of this issue of aging with a significant decrease in the agricultural working population, there is an urgent need to make agriculture smart.

The key to smart agriculture is the utilization of robots, AI, IoT, ICT and other advanced technologies. Introducing self-driving tractors, self-navigating drones, yield combine harvesters, harvesting robots, drones and other technologies into agriculture will solve long-standing challenges and secure a workforce of skilled workers while saving on labor and manpower. The goal is to realize a new and advanced form of agriculture in which yield and quality improve, costs decrease, and incomes increases.

MAFF started a smart agriculture project in 2019. The ministry has been conducting technology demonstration experiments in 148 regions throughout Japan. It has been using robots, AI, IoT, and other advanced technologies at production sites to ascertain the management effect in an integrated experiment from production to shipping. The ministry is hoping for this to lead to social implementation. Let's take a look at some examples of smart agriculture.

A leading agricultural machinery manufacturer in Japan launched self-driving tractors and robot tractors. Introduced in 2018, both use satellites and fixed base stations. This manufacturer adopted a system in which these auto tractors verify their position with satellites to improve accuracy by adding corrected information from fixed base stations. These auto tractors realize self-driving (self-driving level 1) by automating some steering-wheel operations while the user is on board. This enables high-precision work regardless of the user’s skill level. Meanwhile, the robot tractors run autonomously (self-driving level 2) under the supervision of the user, enabling unmanned independent work.

It is possible to realize collaborative work in which one person can handle the work of two people by combining this IoT-equipped robot tractor (unmanned) with a manned tractor. Moreover, it is possible to perform multiple tasks simultaneously. It is also more efficient since work is not affected by the weather.

The unmanned work area when this product was first released was 69% of a field area (range for crop cultivation), specifically 122 × 76 meters. However, this was raised to 72% by expanding the headland (space in which rice planters turn). Furthermore, an outer circumference process was added to boost this percentage to 88%. The manufacturer is striving to reach as close to 100% as possible.

The company has enabled self-driving at low speed by equipping a multi-frequency antenna to the robot tractor to stabilize positional information. It is also working on the development of technology to improve the accuracy of simultaneous sowing work. In addition, the manufacturer has commercialized an auto rice planter that turns automatically. The aim of this is to reduce driver fatigue. The company is proceeding with the development and commercialization under its goal of converting things with steering wheels to smart pilot systems to make them all unmanned in the future.

Another manufacturer that specializes in agricultural machinery is applying belt pinching and transporting technology to commercialize harvesters that automatically farm carrots, radishes, sweet corn, cabbages, and napa cabbages without damaging them. This is expanding the range of automation in agriculture. The company is using a camera, GPS antenna, automatic steering devices, and control devices to realize the development of an unmanned self-driving harvester and automatic carrier in a cabbage harvester project.

A major telecommunications company and multiple drone manufacturers established a new company in January of this year. This new organization promotes and advocates for smart agriculture (e.g. using drones in agricultural chemical spraying, fertilization and crop growth inspections), inspection and maintenance services, and various data collection (by drones) solutions. It is also possible to see the movement to embark on the automatization of work, information-sharing, and data utilization through the conversion to IoT using drones.

In response to this, the business drone market in Japan (total of services, peripheral services and aircraft) almost doubled from 50.3 billion yen in FY2017 to 93.1 billion yen in FY2018. It has continued to grow significantly since, doubling to 193.2 billion yen in FY2020. The market is forecast to reach 408.6 billion yen in FY2023 and 642.7 billion yen in FY2025. (According to the Drone Business Survey Report 2020 by Impress Corporation)

Looking at trends that are driving the drone market, agriculture was solidly in the top place until FY2020. It will give up its position to the inspection industry in FY2021, but the gap between the two sectors will only be slight. There will also be a large gap with the sectors in third place and below, including civil engineering and construction, crime prevention, and aerial photography. It is expected that logistics will grow significantly by FY2025 and that agriculture will claim the second place with approximately 20% of the overall market. It is, however, expected to become a 100 billion yen market.

Agricultural leaders are focusing their efforts on management improvements in response to these market trends. These include the expansion of fields, farmland consolidation, measures against devasted farmland and abandoned fields, and twice-yearly crops. At the same time, the effects of labor- and manpower-saving with the introduction of smart agricultural machinery using IoT are also appearing. For example, the managed area per management entity is increasing year by year according to Trends by Managed Cultivated Area Size. The survey sites that the farmland ratio accounted for by management entities of 10 hectares or more has risen from 34% in 2005 to 56% in 2020. Various challenges remain to fully leverage smart agricultural machinery to solve pressing agriculture issues.